" Seandainya UN PBB dapat mengvaluasi segala kegiatannya, dan juga bisa mengukur berbagai keberhasilan dan kekurangannya alangkah lebih baik." Namun mengevaluasi sebegitu besarnya kegiatan yang dilakukan UN PBB setidaknya perlu kehati-hatian oleh sebab berbagai kegiatan yang di lakukan UN PBB sangat banyak dan segalanya berjalan sesuai pedoman. Cetus Andri Luntungan pengamat International saat dimintai tanggapanya mengenai perlunya UN PBB Divaluasi Malam ini pada online. Andri juga menilai bahwa setiap sebuah pekerjaan setidaknya perlu ada evaluasi, Sepengetahuan saya di sana (Uneg), mereka yang punya kewajiban buat mengevaluasi segala kegiatan UN PBB. Dan saya minta kepada (uneg) segera mengadakan koordinasi buat mengevaluasi segala kegiatan UN PBB itu. Apa yang dikatakan Andri itu dengan cepat menampat sambutan terbukti Deborah Rugg, Ketua Kelompok Evaluasi UN (uneg) dan Direktur Inspeksi dan Evaluasi di Kantor Pelayanan Pengawasan Intern (OIOS). 13 Maret 2015 - Evaluasi akan menjadi lebih diperlukan untuk Pembangunan Berkelanjutan Tujuan pasca-2015, badan PBB mengatakan hari ini, karena meluncurkan publikasi baru menyoroti peran penting dari penilaian dalam meningkatkan efektifitas PBB, budidaya perubahan dan memberdayakan bangsa. "Kita harus meninjau apa yang kita pelajari menerapkan Tujuan Pembangunan Milenium - apa yang berhasil dan apa yang tidak bekerja," Deborah Rugg, Ketua Kelompok Evaluasi UN (uneg), mengatakan dalam sebuah rilis berita. "Sebagai evaluator, kami menawarkan bukti untuk menjawab pertanyaan-pertanyaan ini dan membantu menentukan apa yang perlu dilakukan secara berbeda." Laporan baru Grup, berjudul 'Evaluasi Perubahan Kehidupan - Menyadari Potensi Evaluasi untuk Menginformasikan Development Goals Berkelanjutan Global, "berfokus pada topik mulai dari kesetaraan gender, meningkatkan akuntabilitas publik, mengurangi emisi gas rumah kaca dan melindungi warga sipil di daerah konflik. Ini menyatakan, misalnya, bahwa evaluasi efektivitas penjaga perdamaian misi 'dalam melindungi warga sipil disorot link lemah dalam operasi penjaga perdamaian untuk ditinjau oleh Dewan Keamanan, negara dan misi-kontribusi pasukan, dan membuka jalan bagi tinjauan komprehensif baru dengan luas dampak. Menurut publikasi uneg, peningkatan kapasitas untuk evaluasi di tingkat negara sangat penting untuk kepemilikan agenda pembangunan dan peningkatan akuntabilitas publik, seperti yang disaksikan oleh keberhasilan Asosiasi Evaluasi Maroko dan sistem monitoring dan evaluasi nasional Filipina. Peluncuran resmi publikasi berlangsung selama 2015 uneg Evaluasi Minggu (09-13 Maret), yang membawa bersama-sama evaluator PBB dari seluruh dunia untuk membahas masuknya evaluasi dalam agenda pembangunan pasca-2015 melalui pembangunan kapasitas evaluasi. "Evaluasi mana-mana, dan pada setiap tingkat, akan memainkan peran kunci dalam melaksanakan agenda pembangunan baru," kata Sekretaris Jenderal Ban Ki-moon pada acara tingkat tinggi dari Minggu Evaluasi. "Evaluasi tidak mudah. Juga tidak populer. Tapi itu penting. Kita semua berbagi tanggung jawab untuk memperkuat fungsi penting ini. " Pada tanggal 19 Desember 2014, Majelis Umum mengadopsi resolusi pertama pada evaluasi dan juga ditunjuk tahun 2015 sebagai Tahun Internasional Evaluasi. The uneg adalah jaringan profesional antar-lembaga yang menyatukan unit evaluasi sistem PBB, termasuk departemen PBB, badan-badan khusus, dana dan program, dan organisasi-organisasi afiliasinya. Saat ini memiliki 45 anggota dan tiga pengamat. Misi uneg adalah untuk mempromosikan kredibilitas dan kegunaan dari fungsi evaluasi seluruh sistem PBB.

" Seandainya UN PBB dapat mengvaluasi segala kegiatannya, dan juga bisa mengukur berbagai keberhasilan dan kekurangannya alangkah lebih baik." Namun mengevaluasi sebegitu besarnya kegiatan yang dilakukan UN PBB setidaknya perlu kehati-hatian oleh sebab berbagai kegiatan yang di lakukan UN PBB sangat banyak dan segalanya berjalan sesuai pedoman. Cetus Andri Luntungan pengamat International saat dimintai tanggapanya mengenai perlunya UN PBB Divaluasi Malam ini pada online. Andri juga menilai bahwa setiap sebuah pekerjaan setidaknya perlu ada evaluasi, Sepengetahuan saya di sana (Uneg), mereka yang punya kewajiban buat mengevaluasi segala kegiatan UN PBB. Dan saya minta kepada (uneg) segera mengadakan koordinasi buat mengevaluasi segala kegiatan UN PBB itu. Apa yang dikatakan Andri itu dengan cepat menampat sambutan terbukti Deborah Rugg, Ketua Kelompok Evaluasi UN (uneg) dan Direktur Inspeksi dan Evaluasi di Kantor Pelayanan Pengawasan Intern (OIOS). 13 Maret 2015 - Evaluasi akan menjadi lebih diperlukan untuk Pembangunan Berkelanjutan Tujuan pasca-2015, badan PBB mengatakan hari ini, karena meluncurkan publikasi baru menyoroti peran penting dari penilaian dalam meningkatkan efektifitas PBB, budidaya perubahan dan memberdayakan bangsa. "Kita harus meninjau apa yang kita pelajari menerapkan Tujuan Pembangunan Milenium - apa yang berhasil dan apa yang tidak bekerja," Deborah Rugg, Ketua Kelompok Evaluasi UN (uneg), mengatakan dalam sebuah rilis berita. "Sebagai evaluator, kami menawarkan bukti untuk menjawab pertanyaan-pertanyaan ini dan membantu menentukan apa yang perlu dilakukan secara berbeda." Laporan baru Grup, berjudul 'Evaluasi Perubahan Kehidupan - Menyadari Potensi Evaluasi untuk Menginformasikan Development Goals Berkelanjutan Global, "berfokus pada topik mulai dari kesetaraan gender, meningkatkan akuntabilitas publik, mengurangi emisi gas rumah kaca dan melindungi warga sipil di daerah konflik. Ini menyatakan, misalnya, bahwa evaluasi efektivitas penjaga perdamaian misi 'dalam melindungi warga sipil disorot link lemah dalam operasi penjaga perdamaian untuk ditinjau oleh Dewan Keamanan, negara dan misi-kontribusi pasukan, dan membuka jalan bagi tinjauan komprehensif baru dengan luas dampak. Menurut publikasi uneg, peningkatan kapasitas untuk evaluasi di tingkat negara sangat penting untuk kepemilikan agenda pembangunan dan peningkatan akuntabilitas publik, seperti yang disaksikan oleh keberhasilan Asosiasi Evaluasi Maroko dan sistem monitoring dan evaluasi nasional Filipina. Peluncuran resmi publikasi berlangsung selama 2015 uneg Evaluasi Minggu (09-13 Maret), yang membawa bersama-sama evaluator PBB dari seluruh dunia untuk membahas masuknya evaluasi dalam agenda pembangunan pasca-2015 melalui pembangunan kapasitas evaluasi. "Evaluasi mana-mana, dan pada setiap tingkat, akan memainkan peran kunci dalam melaksanakan agenda pembangunan baru," kata Sekretaris Jenderal Ban Ki-moon pada acara tingkat tinggi dari Minggu Evaluasi. "Evaluasi tidak mudah. Juga tidak populer. Tapi itu penting. Kita semua berbagi tanggung jawab untuk memperkuat fungsi penting ini. " Pada tanggal 19 Desember 2014, Majelis Umum mengadopsi resolusi pertama pada evaluasi dan juga ditunjuk tahun 2015 sebagai Tahun Internasional Evaluasi. The uneg adalah jaringan profesional antar-lembaga yang menyatukan unit evaluasi sistem PBB, termasuk departemen PBB, badan-badan khusus, dana dan program, dan organisasi-organisasi afiliasinya. Saat ini memiliki 45 anggota dan tiga pengamat. Misi uneg adalah untuk mempromosikan kredibilitas dan kegunaan dari fungsi evaluasi seluruh sistem PBB.

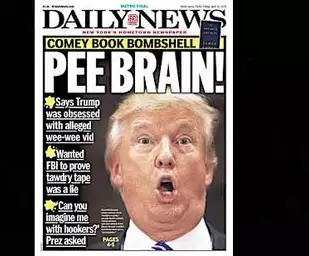

The latest Employment Situation report from the Bureau of Labor Statistics shows weekly employee earnings have grown $75 since tax reform passed, well short of the $4,000 to $9,000 annual increases projected by President Trump Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan

Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

During the three months following passage of the tax bill, the average American saw a $6.21 increase in average weekly earnings. Assuming 12 weeks of work during the three months following passage of the corporate tax cuts, this equates to a $75 increase.

Assuming a full 52 weeks of work, the $6.21 increase in weekly earnings would result in a $323 annual increase, nowhere near the minimum $4,000 promised and $9,000 potential annual increases projected by President Trump and Speaker Ryan if significant cuts were made to corporate tax rates.

Unless something drastically changes, it seems that Americans are going to have to settle for much less than the $4,000 to $9,000 projected wage increases. An extra $322 a year isn’t going to do much to pay down the $1 trillion in additional debt they are projected to take on as a result of the tax cuts.

Yet, a key part of the argument for the recently passed corporate tax cuts and more than a trillion dollars in debt was the substantial wage hike promised by the president’s Council of Economic Advisers (CEA).

From a document titled, “Corporate Tax Reform and Wages: Theory and Evidence,” on the White House’s website:

“Reducing the statutory federal corporate tax rate from 35 to 20 percent would, the analysis below suggests, increase average household income in the United States by, very conservatively, $4,000 annually.”

The document goes on to say:

“When we use the more optimistic estimates from the literature, wage boosts are over $9,000 for the average U.S. household.”

No less than Speaker Ryan’s website trumpeted the Council of Economic Advisers report claiming that on average, the proposed corporate tax cuts would result in at least a $4,000 annual increase in wages.

Now, some supporters of the tax bill may say this analysis is unfair because it is too early for the effects of the tax bill to show up in wages. By that logic, they also shouldn’t take credit for reported employment growth increases.

Still others may point to the $1,000 bonuses announced by some companies shortly after passage of the tax bill. First, that is significantly less than the promised $4,000 to $9,000. Second, these are not wage increases; these are one-time bonuses.

Will companies pay them again, and if so when? Third, the $1,000 represents a fraction of the estimated potential company tax savings.

Using 2016 net income, 2016 effective tax rates, the new 21-percent corporate tax rate and company bonuses, we estimated company bonuses as a percentage of a number of company’s potential tax savings. The results: In many cases, the bonuses represent a mere pittance of the possible tax savings.

Navient announced that it would be giving $1,000 bonuses to 98 percent of its 6,7000 employees, paying out nearly $7 million in bonuses. While that may seem generous, it pales in comparison to Navient’s potential tax savings.

Using Navient’s 2016 net income, its 2016 effective tax rate, estimated annual tax savings of nearly $200 million and its announced bonuses, we calculated that the announced bonuses represent less than 4 percent of Navient’s potential tax savings.

Turning to the airline industry, JetBlue’s employees might be feeling blue if they realized that their $1,000 bonuses are estimated to be less than 10 percent of JetBlue’s potential tax savings, while American Airlines’ bonuses are estimated to represent less than 15 percent of its estimated potential annual tax savings

Not to be outdone, Comcast’s bonuses represent less than 8 percent of its estimated potential annual tax savings, while Walmart appears downright generous, giving an estimated $0.16 of every dollar of its estimated potential annual tax savings to employees in the form of bonuses.

Source: Solutionomics

What happened to the minimum $4,000 promised? I guess like many promises by politicians, they were empty. Instead, they seem to have gone to share buybacks. For the period December 2017 through February 2018, share buybacks more than doubled to $200 million.

Is a $323 wage increase and a one-time bonus of $1,000 that represents a fraction of estimated potential company tax savings worth the more than $1 trillion in additional debt placed on Americans? Is this the best Congress could do? No.

Instead, Congress could have simply made each company’s tax cut contingent on each company increasing wages. The problem is that some companies receiving tax cuts didn’t raise wages.

If Congress had made each company’s tax cut contingent on each company’s wage increases, the American people would have gotten more bang for their tax cut bucks. Additionally, this would have created a real incentive for companies to raise wages: Increase wages, get a tax cut; don’t and you won’t.

If the justification for saddling the American people with at least $1 trillion in additional debt was greater wage growth, tax cuts should have been tied to each company’s wage growth; that’s just logical. That’s getting a better deal for the American people, and that’s getting a better return on investment.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he's a contributor to the Fed Beige Book. Find him on Twitter: @solutionomics.

Saya telah berpikir bahwa semua perusahaan pinjaman online curang sampai saya bertemu dengan perusahaan pinjaman Suzan yang meminjamkan uang tanpa membayar lebih dulu.

BalasHapusNama saya Amisha, saya ingin menggunakan media ini untuk memperingatkan orang-orang yang mencari pinjaman internet di Asia dan di seluruh dunia untuk berhati-hati, karena mereka menipu dan meminjamkan pinjaman palsu di internet.

Saya ingin membagikan kesaksian saya tentang bagaimana seorang teman membawa saya ke pemberi pinjaman asli, setelah itu saya scammed oleh beberapa kreditor di internet. Saya hampir kehilangan harapan sampai saya bertemu kreditur terpercaya ini bernama perusahaan Suzan investment. Perusahaan suzan meminjamkan pinjaman tanpa jaminan sebesar 600 juta rupiah (Rp600.000.000) dalam waktu kurang dari 48 jam tanpa tekanan.

Saya sangat terkejut dan senang menerima pinjaman saya. Saya berjanji bahwa saya akan berbagi kabar baik sehingga orang bisa mendapatkan pinjaman mudah tanpa stres. Jadi jika Anda memerlukan pinjaman, hubungi mereka melalui email: (Suzaninvestment@gmail.com) Anda tidak akan kecewa mendapatkan pinjaman jika memenuhi persyaratan.

Anda juga bisa menghubungi saya: (Ammisha1213@gmail.com) jika Anda memerlukan bantuan atau informasi lebih lanjut