"sering orang yang punya kesalahan jika dia ketahuan akalnya digunakan,artinya dia berpikir dengan segala cara buat berkelit dari segala mengelak atas kesalahan itu,dan itu sering sekali berlaku bagi mereka yang kurang punya jiwa jujur,atau dia lebih suka mendustakan diri sendiri." Mengapa hal itu harus berlaku, dan itu bisa mengena pada warga juga sampai pada mereka yang telah duduk dimeja bundar, dan meja-meja penting lainnya,dan orang sering mengatakan bahwa manusia bukan malaikat, atau artinya setiap manusia pasti punya kesalahan."Apakah benar seperti itu.? jika benar bahwa setip manusia yang hidup di Indonesia telah terjerumus dalam kelam, dan prilaku mereka pernah mendustakan diri kira-kira seperti apalagi yang bisa diharapkan.?, Siapa diantara manusia dijaman ini yang dianggap masih sempurna?. dan siapa juga dijaman ini ada manusia yang tetap dalam kesucian,?. Pertanyaan ini tidak perlu dijawab tetapi tinggal direnungkan oleh setiap individu,Demikian andri Luntungan Pengamat Kemanusiaan International mengatakan pada online saat dimintai tanggapannya manusia telah terjadi dekadensi moral. dan andri juga menilai bahwa dijaman sekarang orang lebih sering bersepekulasi dan berkomoplase, ketimbang dia berbuat sesuai dengan keaslian, artinya wajah -wajah mereka bagaikan seorang yang ramah dan wajah mereka seperti orang baik padahal dibalik semua itu tersimpan berbagai kekejaman,Sekarang hasil para tukang ramal adalah tahun kambing,artinya ditahun kambing ini orang banyak yang dikorbankan, dan orang diadu dombakan, seandainya kurang -kurang bisa membaca setidaknya akan terjadi sebuah kegaduhan yang meluas sampai ketingkat global.Cetus andri. Dia juga menilai ditahun ini di Indonesia manusia mulai dikorbankan, dan mereka ditembak, dan kejadian itu seperti beruntun bagaikan tidak ada lagi belas kasihan, Katanya orang itu dieksekusi di pulau cilacap, mendengar semua itu bagaimana hati nurani anda jika kebetulan disana yang akan dieksekusi adalah keluaraga anda.?.Tuhan tidak pernah akan memafkan bagi manusia yang telah membunuh sesamanya,kecuali dimedan perang,"Apakah orang yang dipenjara itu lagi perang dan bersenjata.?. Ciba semua belajar membuka kembali buku panduan perang, "siapa saja yang bisa ditembak,? 1, seorang musuh yang tidak siap menyerah,dan senjatanya terhunus,2, tawanan yang mncoba merebut senjata,ini bisa ditembak,dan sipa juga yang tidak bisa ditembak di medan, perang,? 1 musuh yang menyerah dan mengibarkan bendara putih, 2 Palang merah Indonesia, 3 Diplomat, Jurnalis. Iinlah yang tertera dalam buku panduan perang, "pertanyaanya apakah sekarang orang yang akan dieksekusi itu benar sedang perang.? ataukah Indonesia saat lagi daloam keadaan perang?. Cetus andri. " Dia hanya bisa berharap segala yang sudah lemah dan tidak berdaya selayaknya ada pengampunan dan segala yang sudah terkulai perlu ada pengampunan.Semoga. Dan Andri menilai bahwa dijaman ini setidaknya semua tahu adalah mansia sedang membuat sensasi dan pencitraan, padahal dibalik semua itu ada keganjilan dan kemunafikan, seandainya kemunafikan itu seperti dibiarkan dan tidak segera disadari oleh dirinya, setiap napas dan tindak laku manusia Tuhan pasti mengerti. dan segala wajah-wajah munafik akan terbuka nantinya."Okey mungkin sekarang evoria didalam dirinya oleh sebab dia sedang menjadi pejabat seakan-akan dia yang memiliki segalanya, tetapi jika pada batas waktunya Tuhan berkehendak buat mencabut segala jabatanya, dan dia juga akan terkena ekssekusi bisa dibayangkan bagaiman perihnya."Siapa yang tidak akan tersentuh menanti sebuah kematian,? raja setan juga yang tidak memiliki hati nurani jika anaknya akan dibunuh punya rasah sedih, lantas bagaimana dengan manusia yang memiliki kesmpurnaan,apakah akan melebih setan kejamnya.?, Maaf jangan marah, saya hanya sebatas memberikan perumpamaan. Dan saya hanya berharap kepada semua agar bisa mempertimbangkan kembali. katanya.

"sering orang yang punya kesalahan jika dia ketahuan akalnya digunakan,artinya dia berpikir dengan segala cara buat berkelit dari segala mengelak atas kesalahan itu,dan itu sering sekali berlaku bagi mereka yang kurang punya jiwa jujur,atau dia lebih suka mendustakan diri sendiri." Mengapa hal itu harus berlaku, dan itu bisa mengena pada warga juga sampai pada mereka yang telah duduk dimeja bundar, dan meja-meja penting lainnya,dan orang sering mengatakan bahwa manusia bukan malaikat, atau artinya setiap manusia pasti punya kesalahan."Apakah benar seperti itu.? jika benar bahwa setip manusia yang hidup di Indonesia telah terjerumus dalam kelam, dan prilaku mereka pernah mendustakan diri kira-kira seperti apalagi yang bisa diharapkan.?, Siapa diantara manusia dijaman ini yang dianggap masih sempurna?. dan siapa juga dijaman ini ada manusia yang tetap dalam kesucian,?. Pertanyaan ini tidak perlu dijawab tetapi tinggal direnungkan oleh setiap individu,Demikian andri Luntungan Pengamat Kemanusiaan International mengatakan pada online saat dimintai tanggapannya manusia telah terjadi dekadensi moral. dan andri juga menilai bahwa dijaman sekarang orang lebih sering bersepekulasi dan berkomoplase, ketimbang dia berbuat sesuai dengan keaslian, artinya wajah -wajah mereka bagaikan seorang yang ramah dan wajah mereka seperti orang baik padahal dibalik semua itu tersimpan berbagai kekejaman,Sekarang hasil para tukang ramal adalah tahun kambing,artinya ditahun kambing ini orang banyak yang dikorbankan, dan orang diadu dombakan, seandainya kurang -kurang bisa membaca setidaknya akan terjadi sebuah kegaduhan yang meluas sampai ketingkat global.Cetus andri. Dia juga menilai ditahun ini di Indonesia manusia mulai dikorbankan, dan mereka ditembak, dan kejadian itu seperti beruntun bagaikan tidak ada lagi belas kasihan, Katanya orang itu dieksekusi di pulau cilacap, mendengar semua itu bagaimana hati nurani anda jika kebetulan disana yang akan dieksekusi adalah keluaraga anda.?.Tuhan tidak pernah akan memafkan bagi manusia yang telah membunuh sesamanya,kecuali dimedan perang,"Apakah orang yang dipenjara itu lagi perang dan bersenjata.?. Ciba semua belajar membuka kembali buku panduan perang, "siapa saja yang bisa ditembak,? 1, seorang musuh yang tidak siap menyerah,dan senjatanya terhunus,2, tawanan yang mncoba merebut senjata,ini bisa ditembak,dan sipa juga yang tidak bisa ditembak di medan, perang,? 1 musuh yang menyerah dan mengibarkan bendara putih, 2 Palang merah Indonesia, 3 Diplomat, Jurnalis. Iinlah yang tertera dalam buku panduan perang, "pertanyaanya apakah sekarang orang yang akan dieksekusi itu benar sedang perang.? ataukah Indonesia saat lagi daloam keadaan perang?. Cetus andri. " Dia hanya bisa berharap segala yang sudah lemah dan tidak berdaya selayaknya ada pengampunan dan segala yang sudah terkulai perlu ada pengampunan.Semoga. Dan Andri menilai bahwa dijaman ini setidaknya semua tahu adalah mansia sedang membuat sensasi dan pencitraan, padahal dibalik semua itu ada keganjilan dan kemunafikan, seandainya kemunafikan itu seperti dibiarkan dan tidak segera disadari oleh dirinya, setiap napas dan tindak laku manusia Tuhan pasti mengerti. dan segala wajah-wajah munafik akan terbuka nantinya."Okey mungkin sekarang evoria didalam dirinya oleh sebab dia sedang menjadi pejabat seakan-akan dia yang memiliki segalanya, tetapi jika pada batas waktunya Tuhan berkehendak buat mencabut segala jabatanya, dan dia juga akan terkena ekssekusi bisa dibayangkan bagaiman perihnya."Siapa yang tidak akan tersentuh menanti sebuah kematian,? raja setan juga yang tidak memiliki hati nurani jika anaknya akan dibunuh punya rasah sedih, lantas bagaimana dengan manusia yang memiliki kesmpurnaan,apakah akan melebih setan kejamnya.?, Maaf jangan marah, saya hanya sebatas memberikan perumpamaan. Dan saya hanya berharap kepada semua agar bisa mempertimbangkan kembali. katanya.

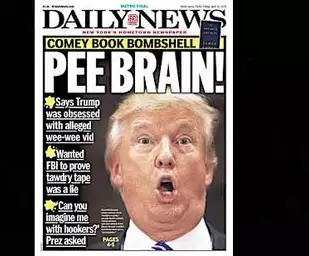

The latest Employment Situation report from the Bureau of Labor Statistics shows weekly employee earnings have grown $75 since tax reform passed, well short of the $4,000 to $9,000 annual increases projected by President Trump Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan

Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

During the three months following passage of the tax bill, the average American saw a $6.21 increase in average weekly earnings. Assuming 12 weeks of work during the three months following passage of the corporate tax cuts, this equates to a $75 increase.

Assuming a full 52 weeks of work, the $6.21 increase in weekly earnings would result in a $323 annual increase, nowhere near the minimum $4,000 promised and $9,000 potential annual increases projected by President Trump and Speaker Ryan if significant cuts were made to corporate tax rates.

Unless something drastically changes, it seems that Americans are going to have to settle for much less than the $4,000 to $9,000 projected wage increases. An extra $322 a year isn’t going to do much to pay down the $1 trillion in additional debt they are projected to take on as a result of the tax cuts.

Yet, a key part of the argument for the recently passed corporate tax cuts and more than a trillion dollars in debt was the substantial wage hike promised by the president’s Council of Economic Advisers (CEA).

From a document titled, “Corporate Tax Reform and Wages: Theory and Evidence,” on the White House’s website:

“Reducing the statutory federal corporate tax rate from 35 to 20 percent would, the analysis below suggests, increase average household income in the United States by, very conservatively, $4,000 annually.”

The document goes on to say:

“When we use the more optimistic estimates from the literature, wage boosts are over $9,000 for the average U.S. household.”

No less than Speaker Ryan’s website trumpeted the Council of Economic Advisers report claiming that on average, the proposed corporate tax cuts would result in at least a $4,000 annual increase in wages.

Now, some supporters of the tax bill may say this analysis is unfair because it is too early for the effects of the tax bill to show up in wages. By that logic, they also shouldn’t take credit for reported employment growth increases.

Still others may point to the $1,000 bonuses announced by some companies shortly after passage of the tax bill. First, that is significantly less than the promised $4,000 to $9,000. Second, these are not wage increases; these are one-time bonuses.

Will companies pay them again, and if so when? Third, the $1,000 represents a fraction of the estimated potential company tax savings.

Using 2016 net income, 2016 effective tax rates, the new 21-percent corporate tax rate and company bonuses, we estimated company bonuses as a percentage of a number of company’s potential tax savings. The results: In many cases, the bonuses represent a mere pittance of the possible tax savings.

Navient announced that it would be giving $1,000 bonuses to 98 percent of its 6,7000 employees, paying out nearly $7 million in bonuses. While that may seem generous, it pales in comparison to Navient’s potential tax savings.

Using Navient’s 2016 net income, its 2016 effective tax rate, estimated annual tax savings of nearly $200 million and its announced bonuses, we calculated that the announced bonuses represent less than 4 percent of Navient’s potential tax savings.

Turning to the airline industry, JetBlue’s employees might be feeling blue if they realized that their $1,000 bonuses are estimated to be less than 10 percent of JetBlue’s potential tax savings, while American Airlines’ bonuses are estimated to represent less than 15 percent of its estimated potential annual tax savings

Not to be outdone, Comcast’s bonuses represent less than 8 percent of its estimated potential annual tax savings, while Walmart appears downright generous, giving an estimated $0.16 of every dollar of its estimated potential annual tax savings to employees in the form of bonuses.

Source: Solutionomics

What happened to the minimum $4,000 promised? I guess like many promises by politicians, they were empty. Instead, they seem to have gone to share buybacks. For the period December 2017 through February 2018, share buybacks more than doubled to $200 million.

Is a $323 wage increase and a one-time bonus of $1,000 that represents a fraction of estimated potential company tax savings worth the more than $1 trillion in additional debt placed on Americans? Is this the best Congress could do? No.

Instead, Congress could have simply made each company’s tax cut contingent on each company increasing wages. The problem is that some companies receiving tax cuts didn’t raise wages.

If Congress had made each company’s tax cut contingent on each company’s wage increases, the American people would have gotten more bang for their tax cut bucks. Additionally, this would have created a real incentive for companies to raise wages: Increase wages, get a tax cut; don’t and you won’t.

If the justification for saddling the American people with at least $1 trillion in additional debt was greater wage growth, tax cuts should have been tied to each company’s wage growth; that’s just logical. That’s getting a better deal for the American people, and that’s getting a better return on investment.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he's a contributor to the Fed Beige Book. Find him on Twitter: @solutionomics.

Tidak ada komentar:

Posting Komentar