Seandainya UN PBB, terus menurus tidak mampuh untuk bisa mencegah hukuman mati di Indonesia menandakan bahwa hasil Mou di jenewa telah di abaikan oleh Indonesia, artinya kesepakatan perlindungan HAM, yang telah disepakati oleh berbagai kepala negara yang menyangkut masalah perlindungan hak manusia untuk hidup seakan-akan telah disepelehkan bahkan seperti dianggap tidak berarti lagi.demikian ungkap andri luntungan Pengamat International saat dimintai tanggapannya dugaan UN PBB terlambat Menghimbau Indonesia, untuk menghilangkan Hukuman mati.Andri juga meminta lembaga Hak Asasi Manusia di UN PBB buat segera bisa menghimbau kembali segala kepala Negara yang memberlakukan Hukuman mati bisa segera dihentikan jika perlu jangan adalagi pemeberlakuannya, oleh sebab sudah tidak sejalan dengan era globalisasi, disamping itu juga saya tidak sepaham jika di jaman yang sudah begitu penuh dengan kemajuan teknologi masih ada pemberlakuan hukuman mati."Artinya buat apa disetiap negara ada sebuah penjara, jika tidak bisa membuat jerah, dan buat apa juga ada lembaga pemasyarakatan jika tidak mampuh membuat mereka menjadi baik.?" Okey sekarang saya lebih menekan buat lembaga Ham di PBB untuk terus menyuarakan mengenai perlindungan Hidup Manusia. Dan andri juga tidak hentinya-hentinya mengatakan kepada UN PBB buat memberikan keselamatan bagi seluruh manusia, buat tetap bisa hidup,artinya dijaman yang telah terbuka tidak layak masih ada negara yang memberlakukan hukuman mati. Dan Andri minta Kepada Komisaris Tinggi PBB Untuk hak asasi Manusia bisa menghentkan tindakan hukuman mati cetusnya. Apa yang dikatakan Andri Luntungan Mendapat respon dari Komisaris Tinggi PBB untuk Hak Asasi Manusia mengatakan hari ini saat ia mendesak negara-negara anggota untuk menegakkan prinsip-prinsip hak asasi manusia yang mendasari komunitas mereka dalam perjuangan mereka melawan radikalisme. Berbicara kepada 47 anggota Dewan HAM PBB sebelumnya hari ini, Komisaris Tinggi PBB untuk Hak Asasi Manusia, Zeid Ra'ad Al Hussein memperingatkan "bahaya nyata" bahwa pendapat-pemimpin dan pengambil keputusan akan "kehilangan genggaman mereka" dari nilai-nilai Ketika para pemimpin yang kuat merasa terancam oleh tweet, blog, atau pidato siswa SMA itu, ini berbicara tentang weakness.States mendasari mendalam dibangun 70 tahun yang lalu "untuk menangkal kengerian perang." "Perang melawan teror adalah perjuangan untuk menegakkan nilai-nilai demokrasi dan hak asasi manusia - tidak merusak mereka," Mr. Zeid menyatakan. "Operasi anti-teroris yang non-spesifik, tidak proporsional, brutal dan tidak cukup diawasi melanggar norma-norma yang sangat kita berusaha untuk mempertahankan. Mereka juga berisiko menyerahkan teroris alat propaganda - sehingga membuat masyarakat kita tidak bebas dan aman ". Pada saat yang sama, kepala hak asasi manusia PBB mengatakan dia "terkejut" oleh "meningkatnya gelombang serangan" di seluruh dunia menargetkan orang-orang karena keyakinan mereka. Seperti "tindakan mengerikan kebencian rasial dan agama," katanya, negara-negara di Eropa Barat dan Amerika Utara, di mana "kepolisian tidak adil, penghinaan harian, dan pengucilan" mempengaruhi sebagian besar wilayah penduduk membentang. Sementara itu, ia menambahkan, "tentakel gerakan ekstremis Takfiri" - sebuah ideologi di mana satu orang percaya kemurtadan lain dan kemudian mengutuk mereka sebagai murni - telah mencapai ke berbagai negara, dari Irak dan Suriah ke Nigeria, Yaman, Libya dan Somalia . Terhadap latar belakang itu, Mr. Zeid menyuarakan keprihatinan yang mendalam pada kecenderungan Amerika untuk menekan paling dasar hak asasi manusia, termasuk penerapan langkah-langkah yang membatasi kebebasan berekspresi dan ruang demokrasi. "Ketika para pemimpin yang kuat merasa terancam oleh tweet, blog, atau pidato siswa SMA itu, ini berbicara tentang kelemahan mendasar yang mendalam," lanjutnya. "Dan ketika penulis diculik, dipenjara, dicambuk, atau dihukum mati; ketika wartawan diserang, mengalami kekerasan seksual, disiksa dan dibunuh; ketika demonstran damai yang ditembak mati oleh preman; ketika pengacara hak asasi manusia, pembela hak asasi manusia dan aktivis tanah ditangkap dan dipenjara atas tuduhan palsu penghasutan; ketika surat kabar diserang atau mematikan - kasus tersebut menyerang dan merusak dasar-dasar pemerintahan yang stabil ". Komisaris Tinggi juga menyatakan penyesalannya pada penggunaan baru dari hukuman mati di sejumlah negara - Jordan, Pakistan, dan Indonesia - dan "penggunaan ekstensif terus" dari hukuman mati di China, Irak, Iran dan Amerika Serikat. "Ini adalah orang-orang yang mempertahankan pemerintahan, menciptakan kemakmuran, menyembuhkan dan mendidik orang lain dan membayar untuk layanan pemerintah dan lainnya dengan tenaga kerja mereka," Mr. Zeid menyimpulkan. "Ini adalah perjuangan mereka yang telah menciptakan dan mempertahankan Negara. Pemerintah ada untuk melayani orang-orang -. Bukan cara putaran lain "

Copy and WIN : http://bit.ly/copynwin

Seandainya UN PBB, terus menurus tidak mampuh untuk bisa mencegah hukuman mati di Indonesia menandakan bahwa hasil Mou di jenewa telah di abaikan oleh Indonesia, artinya kesepakatan perlindungan HAM, yang telah disepakati oleh berbagai kepala negara yang menyangkut masalah perlindungan hak manusia untuk hidup seakan-akan telah disepelehkan bahkan seperti dianggap tidak berarti lagi.demikian ungkap andri luntungan Pengamat International saat dimintai tanggapannya dugaan UN PBB terlambat Menghimbau Indonesia, untuk menghilangkan Hukuman mati.Andri juga meminta lembaga Hak Asasi Manusia di UN PBB buat segera bisa menghimbau kembali segala kepala Negara yang memberlakukan Hukuman mati bisa segera dihentikan jika perlu jangan adalagi pemeberlakuannya, oleh sebab sudah tidak sejalan dengan era globalisasi, disamping itu juga saya tidak sepaham jika di jaman yang sudah begitu penuh dengan kemajuan teknologi masih ada pemberlakuan hukuman mati."Artinya buat apa disetiap negara ada sebuah penjara, jika tidak bisa membuat jerah, dan buat apa juga ada lembaga pemasyarakatan jika tidak mampuh membuat mereka menjadi baik.?" Okey sekarang saya lebih menekan buat lembaga Ham di PBB untuk terus menyuarakan mengenai perlindungan Hidup Manusia. Dan andri juga tidak hentinya-hentinya mengatakan kepada UN PBB buat memberikan keselamatan bagi seluruh manusia, buat tetap bisa hidup,artinya dijaman yang telah terbuka tidak layak masih ada negara yang memberlakukan hukuman mati. Dan Andri minta Kepada Komisaris Tinggi PBB Untuk hak asasi Manusia bisa menghentkan tindakan hukuman mati cetusnya. Apa yang dikatakan Andri Luntungan Mendapat respon dari Komisaris Tinggi PBB untuk Hak Asasi Manusia mengatakan hari ini saat ia mendesak negara-negara anggota untuk menegakkan prinsip-prinsip hak asasi manusia yang mendasari komunitas mereka dalam perjuangan mereka melawan radikalisme. Berbicara kepada 47 anggota Dewan HAM PBB sebelumnya hari ini, Komisaris Tinggi PBB untuk Hak Asasi Manusia, Zeid Ra'ad Al Hussein memperingatkan "bahaya nyata" bahwa pendapat-pemimpin dan pengambil keputusan akan "kehilangan genggaman mereka" dari nilai-nilai Ketika para pemimpin yang kuat merasa terancam oleh tweet, blog, atau pidato siswa SMA itu, ini berbicara tentang weakness.States mendasari mendalam dibangun 70 tahun yang lalu "untuk menangkal kengerian perang." "Perang melawan teror adalah perjuangan untuk menegakkan nilai-nilai demokrasi dan hak asasi manusia - tidak merusak mereka," Mr. Zeid menyatakan. "Operasi anti-teroris yang non-spesifik, tidak proporsional, brutal dan tidak cukup diawasi melanggar norma-norma yang sangat kita berusaha untuk mempertahankan. Mereka juga berisiko menyerahkan teroris alat propaganda - sehingga membuat masyarakat kita tidak bebas dan aman ". Pada saat yang sama, kepala hak asasi manusia PBB mengatakan dia "terkejut" oleh "meningkatnya gelombang serangan" di seluruh dunia menargetkan orang-orang karena keyakinan mereka. Seperti "tindakan mengerikan kebencian rasial dan agama," katanya, negara-negara di Eropa Barat dan Amerika Utara, di mana "kepolisian tidak adil, penghinaan harian, dan pengucilan" mempengaruhi sebagian besar wilayah penduduk membentang. Sementara itu, ia menambahkan, "tentakel gerakan ekstremis Takfiri" - sebuah ideologi di mana satu orang percaya kemurtadan lain dan kemudian mengutuk mereka sebagai murni - telah mencapai ke berbagai negara, dari Irak dan Suriah ke Nigeria, Yaman, Libya dan Somalia . Terhadap latar belakang itu, Mr. Zeid menyuarakan keprihatinan yang mendalam pada kecenderungan Amerika untuk menekan paling dasar hak asasi manusia, termasuk penerapan langkah-langkah yang membatasi kebebasan berekspresi dan ruang demokrasi. "Ketika para pemimpin yang kuat merasa terancam oleh tweet, blog, atau pidato siswa SMA itu, ini berbicara tentang kelemahan mendasar yang mendalam," lanjutnya. "Dan ketika penulis diculik, dipenjara, dicambuk, atau dihukum mati; ketika wartawan diserang, mengalami kekerasan seksual, disiksa dan dibunuh; ketika demonstran damai yang ditembak mati oleh preman; ketika pengacara hak asasi manusia, pembela hak asasi manusia dan aktivis tanah ditangkap dan dipenjara atas tuduhan palsu penghasutan; ketika surat kabar diserang atau mematikan - kasus tersebut menyerang dan merusak dasar-dasar pemerintahan yang stabil ". Komisaris Tinggi juga menyatakan penyesalannya pada penggunaan baru dari hukuman mati di sejumlah negara - Jordan, Pakistan, dan Indonesia - dan "penggunaan ekstensif terus" dari hukuman mati di China, Irak, Iran dan Amerika Serikat. "Ini adalah orang-orang yang mempertahankan pemerintahan, menciptakan kemakmuran, menyembuhkan dan mendidik orang lain dan membayar untuk layanan pemerintah dan lainnya dengan tenaga kerja mereka," Mr. Zeid menyimpulkan. "Ini adalah perjuangan mereka yang telah menciptakan dan mempertahankan Negara. Pemerintah ada untuk melayani orang-orang -. Bukan cara putaran lain "

Copy and WIN : http://bit.ly/copynwin

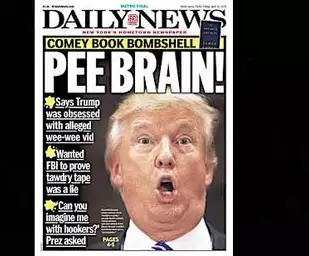

The latest Employment Situation report from the Bureau of Labor Statistics shows weekly employee earnings have grown $75 since tax reform passed, well short of the $4,000 to $9,000 annual increases projected by President Trump Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan

Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

During the three months following passage of the tax bill, the average American saw a $6.21 increase in average weekly earnings. Assuming 12 weeks of work during the three months following passage of the corporate tax cuts, this equates to a $75 increase.

Assuming a full 52 weeks of work, the $6.21 increase in weekly earnings would result in a $323 annual increase, nowhere near the minimum $4,000 promised and $9,000 potential annual increases projected by President Trump and Speaker Ryan if significant cuts were made to corporate tax rates.

Unless something drastically changes, it seems that Americans are going to have to settle for much less than the $4,000 to $9,000 projected wage increases. An extra $322 a year isn’t going to do much to pay down the $1 trillion in additional debt they are projected to take on as a result of the tax cuts.

Yet, a key part of the argument for the recently passed corporate tax cuts and more than a trillion dollars in debt was the substantial wage hike promised by the president’s Council of Economic Advisers (CEA).

From a document titled, “Corporate Tax Reform and Wages: Theory and Evidence,” on the White House’s website:

“Reducing the statutory federal corporate tax rate from 35 to 20 percent would, the analysis below suggests, increase average household income in the United States by, very conservatively, $4,000 annually.”

The document goes on to say:

“When we use the more optimistic estimates from the literature, wage boosts are over $9,000 for the average U.S. household.”

No less than Speaker Ryan’s website trumpeted the Council of Economic Advisers report claiming that on average, the proposed corporate tax cuts would result in at least a $4,000 annual increase in wages.

Now, some supporters of the tax bill may say this analysis is unfair because it is too early for the effects of the tax bill to show up in wages. By that logic, they also shouldn’t take credit for reported employment growth increases.

Still others may point to the $1,000 bonuses announced by some companies shortly after passage of the tax bill. First, that is significantly less than the promised $4,000 to $9,000. Second, these are not wage increases; these are one-time bonuses.

Will companies pay them again, and if so when? Third, the $1,000 represents a fraction of the estimated potential company tax savings.

Using 2016 net income, 2016 effective tax rates, the new 21-percent corporate tax rate and company bonuses, we estimated company bonuses as a percentage of a number of company’s potential tax savings. The results: In many cases, the bonuses represent a mere pittance of the possible tax savings.

Navient announced that it would be giving $1,000 bonuses to 98 percent of its 6,7000 employees, paying out nearly $7 million in bonuses. While that may seem generous, it pales in comparison to Navient’s potential tax savings.

Using Navient’s 2016 net income, its 2016 effective tax rate, estimated annual tax savings of nearly $200 million and its announced bonuses, we calculated that the announced bonuses represent less than 4 percent of Navient’s potential tax savings.

Turning to the airline industry, JetBlue’s employees might be feeling blue if they realized that their $1,000 bonuses are estimated to be less than 10 percent of JetBlue’s potential tax savings, while American Airlines’ bonuses are estimated to represent less than 15 percent of its estimated potential annual tax savings

Not to be outdone, Comcast’s bonuses represent less than 8 percent of its estimated potential annual tax savings, while Walmart appears downright generous, giving an estimated $0.16 of every dollar of its estimated potential annual tax savings to employees in the form of bonuses.

Source: Solutionomics

What happened to the minimum $4,000 promised? I guess like many promises by politicians, they were empty. Instead, they seem to have gone to share buybacks. For the period December 2017 through February 2018, share buybacks more than doubled to $200 million.

Is a $323 wage increase and a one-time bonus of $1,000 that represents a fraction of estimated potential company tax savings worth the more than $1 trillion in additional debt placed on Americans? Is this the best Congress could do? No.

Instead, Congress could have simply made each company’s tax cut contingent on each company increasing wages. The problem is that some companies receiving tax cuts didn’t raise wages.

If Congress had made each company’s tax cut contingent on each company’s wage increases, the American people would have gotten more bang for their tax cut bucks. Additionally, this would have created a real incentive for companies to raise wages: Increase wages, get a tax cut; don’t and you won’t.

If the justification for saddling the American people with at least $1 trillion in additional debt was greater wage growth, tax cuts should have been tied to each company’s wage growth; that’s just logical. That’s getting a better deal for the American people, and that’s getting a better return on investment.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he's a contributor to the Fed Beige Book. Find him on Twitter: @solutionomics.

Tidak ada komentar:

Posting Komentar