Detik Jurnal--Beermitra dengan Bank biasanya ada kecangungan bagi para pemula. Oleh sebab segala syarat administratif bank. "Seringkali masyarakat yang bergerak dibidang usaha memang terbentur dengan modal tapi ketika dia mencoba mengajukan usahanya buat bantuan modal. Bank terkadang menanyakan berbagai syarat yang sangant sulit didapat bagi pengusaha lemah,bahkan banyak perbankan yang telah menjamur diberbagai Propensi dan Kabupaten hampir kurang mau menyentuh kepada pengusaha kecil. Hal inilah yang akhirnya membuat para pengusaha kecil lebih "condong meminjam kepada bank gelap atau istilah sekarang sebutannya rentenir." Persoalan dunia perbankan bagi yang sudah berpengalaman dia biasa,"berkata bahwa bermitra dengan Bank adalah suatu kreteria yang membuat kita memiliki mental usaha kata Andri Luntungan yang Mengunakan Fasilitas Pinjaman Multiguna dari Bank Mandiri,dia berpendapat bahwa -“berpengalaman 2 tahun” atau “laporan keuangan 2 tahun” sering kali muncul. Meski sudah sering saya sampaikan bahwa jangan takut sama Bank, yang penting bisa jualan, bank pasti buka peluang juga. Tapi okelah kalo begitu. Mungkin sobat-sobat saya yang pemula masih agak-agak takut karena tidak tau step by step urutan kerjasama dengan bank. Note, ini hanya untuk pemula yang bekerja di bidang developer properti. Menurut Andrikat Pertama-tama, Anda harus punya lokasi yang akan dikembangkan. Syukur-syukur sudah ada penjualan. Ini mempermudah negosiasi kerjasama. Kalau gak punya lokasi, boro-boro diajak kerjasama. Bisa ngopi bareng sama Account Officernya aja udah lumayan.katanya. diapun manmbahkan 10 poin penting. Siapkan data-data sebagai berikut : 1. Surat Permohonan Kerjasama, bukan surat permohonan ijin tidak masuk kantor dari dokter ya. 2. Proposal proyek yang berisi executive summary, kelayakan proyek, rab bangunan, material promosi seperti brosur, contoh iklan koran dll, peta lokasi, data penjualan, data spesifikasi, daftar harga. Bukan proposal permintaan dana pembangunan fasilitas sosial ya. 3. Legalitas perusahaan seperti akta perusahaan, bukannya akta kelahiran. siup, tdp, npwp. 4. Legalitas proyek seperti perijinan, copy sertifikat, copy PBB. Data-data di atas dibendel dan diperbanyak paling tidak 4 bendel. 1 untuk kepala cabang, 1 untuk kepala bagian kredit, 1 untuk prosesor kredit, 1 untuk administrasi. Untuk berkas ke kepala cabang, usahakan berwarna. Biar lebih makyus. Hey, we must stealing the show, right?! Nah kalau semua berkas sudah terkumpul. ACT NOW! 1. Datanglah ke bank yang dituju. Sekali lagi bank, bukan tempat pembuangan sampah. 2. Kalau jam kerja, gak perlu ketuk pintu karena biasanya ada satpam yang jaga. Kalau di luar jam kerja, ngapain ngurusin kerjasama bank? Kecuali udah janjian. ^_^ 3. Sampaikan bendel tadi ke masing-masing meja. Sempatkan ngobrol dengan masing-masing person. Tak kenal maka ta’aruf bukan?! Untuk bisa mendekatkan diri dengannya. Makin deket, dijamin makin mulus tuh proposal! 4. Setelah itu, pulanglah. Karena Anda bukan pegawai di sana, Anda dilarang menginap!!! 5. Tunggu 1-2 hari untuk datang lagi ke bank tersebut. Cari alasan kenapa Anda datang ke bank lagi. Bikin obrolan santai tanpa harus menyinggung masalah proposal yang Anda sampaikan lalu. 6. Tips biar bisa ngobrol santai adalah tanyakan minat dia dan biarkan dia bercerita tentang minatnya itu. Syukur-syukur minatnya sama. Obrolan bisa jadi gayeng. 7. Kalau gak sama gimana? Besok lagi kalau datang, pasti Anda sudah mencari informasi dari internet atau media apapun tentang minat dia. 8. Setelah kunjungan kedua, ya pulang lagi. Jangan menginap! 9. Kunjungan ketiga, sama alasannya dengan kunjungan kedua. Namun tanyakan progres proposal Anda. Apakah ada yang kurang? Catat apa yang kurang. Pastikan Anda siapkan 1-2 hari kemudian. Nah, dapat alasan untuk datang lagi ke bank bukan?! 10. Ulangi terus kunjungan-kunjungan. Berikan senyum kepada satpam, front office, office boy, teller dan usahakan akrab dengan mereka pula. Jadikan Anda bukan orang asing bagi mereka. Cetusnya.dan adri pun menambahkan alangkah lebih baik bilah segala persyaratan tadi oleh pihak bank dirampingkan,artinya "jangan samakan bagi pengusaha besar dengan pengusaha kecil," saya lebih setuju bilah para pengusaha ekonomi lemah dibebaskan dari segala syarat. "Contohnya bilah dia hanya meminjam lima juta (500.000) ngapain harus dilampirkan Siup TDP NPWP Sertipikat tanah,Surat Nikah,dan lain-lainnya." "anda bayangkan bikin SIUP,TDP dan NPWP belum lagi bikin sertivikat ditambah lagi surat nikah dan membuat proposal apalah mungkin,bagi pengusaha lemah dapat melengkapi segala syarat itu," Secara bruto andakain syarat- syarat tadi harus dilengkapi oleh para pengusaha lemah.Stidaknya dia harus mengeluarkan bia,Bikin Surat Nikah,SIUP TDP NPWP dan sertfikit tanah yng nilainya bilah diglobalkan bisa mencapai ratusan Juta-sementara yang akan dipinjam hanya lima 5000000 juta,"masuk akal tidak?" artinya bilah anda mau meminjam lima juta harus mengeluarkan terlebih dahulu ratusan juta.cetus Andri, diapun berharap kepada semua perbankan bisa member kemudahan kepada pengusaha lemah yang berada dipelosok-pelosok daerah dan berikanlah kemudahan sistem peminjamannya jika perlu hapus suluruh syarat yang terlalu memberatkan itu. kata andri diakhir pembicaraan kepada Andri News baru (Agus dan Anton Jakarta.)

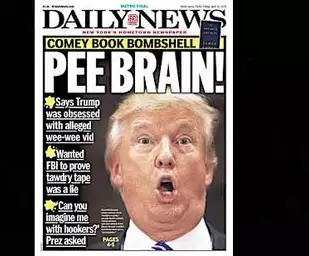

The latest Employment Situation report from the Bureau of Labor Statistics shows weekly employee earnings have grown $75 since tax reform passed, well short of the $4,000 to $9,000 annual increases projected by President Trump Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan

Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

During the three months following passage of the tax bill, the average American saw a $6.21 increase in average weekly earnings. Assuming 12 weeks of work during the three months following passage of the corporate tax cuts, this equates to a $75 increase.

Assuming a full 52 weeks of work, the $6.21 increase in weekly earnings would result in a $323 annual increase, nowhere near the minimum $4,000 promised and $9,000 potential annual increases projected by President Trump and Speaker Ryan if significant cuts were made to corporate tax rates.

Unless something drastically changes, it seems that Americans are going to have to settle for much less than the $4,000 to $9,000 projected wage increases. An extra $322 a year isn’t going to do much to pay down the $1 trillion in additional debt they are projected to take on as a result of the tax cuts.

Yet, a key part of the argument for the recently passed corporate tax cuts and more than a trillion dollars in debt was the substantial wage hike promised by the president’s Council of Economic Advisers (CEA).

From a document titled, “Corporate Tax Reform and Wages: Theory and Evidence,” on the White House’s website:

“Reducing the statutory federal corporate tax rate from 35 to 20 percent would, the analysis below suggests, increase average household income in the United States by, very conservatively, $4,000 annually.”

The document goes on to say:

“When we use the more optimistic estimates from the literature, wage boosts are over $9,000 for the average U.S. household.”

No less than Speaker Ryan’s website trumpeted the Council of Economic Advisers report claiming that on average, the proposed corporate tax cuts would result in at least a $4,000 annual increase in wages.

Now, some supporters of the tax bill may say this analysis is unfair because it is too early for the effects of the tax bill to show up in wages. By that logic, they also shouldn’t take credit for reported employment growth increases.

Still others may point to the $1,000 bonuses announced by some companies shortly after passage of the tax bill. First, that is significantly less than the promised $4,000 to $9,000. Second, these are not wage increases; these are one-time bonuses.

Will companies pay them again, and if so when? Third, the $1,000 represents a fraction of the estimated potential company tax savings.

Using 2016 net income, 2016 effective tax rates, the new 21-percent corporate tax rate and company bonuses, we estimated company bonuses as a percentage of a number of company’s potential tax savings. The results: In many cases, the bonuses represent a mere pittance of the possible tax savings.

Navient announced that it would be giving $1,000 bonuses to 98 percent of its 6,7000 employees, paying out nearly $7 million in bonuses. While that may seem generous, it pales in comparison to Navient’s potential tax savings.

Using Navient’s 2016 net income, its 2016 effective tax rate, estimated annual tax savings of nearly $200 million and its announced bonuses, we calculated that the announced bonuses represent less than 4 percent of Navient’s potential tax savings.

Turning to the airline industry, JetBlue’s employees might be feeling blue if they realized that their $1,000 bonuses are estimated to be less than 10 percent of JetBlue’s potential tax savings, while American Airlines’ bonuses are estimated to represent less than 15 percent of its estimated potential annual tax savings

Not to be outdone, Comcast’s bonuses represent less than 8 percent of its estimated potential annual tax savings, while Walmart appears downright generous, giving an estimated $0.16 of every dollar of its estimated potential annual tax savings to employees in the form of bonuses.

Source: Solutionomics

What happened to the minimum $4,000 promised? I guess like many promises by politicians, they were empty. Instead, they seem to have gone to share buybacks. For the period December 2017 through February 2018, share buybacks more than doubled to $200 million.

Is a $323 wage increase and a one-time bonus of $1,000 that represents a fraction of estimated potential company tax savings worth the more than $1 trillion in additional debt placed on Americans? Is this the best Congress could do? No.

Instead, Congress could have simply made each company’s tax cut contingent on each company increasing wages. The problem is that some companies receiving tax cuts didn’t raise wages.

If Congress had made each company’s tax cut contingent on each company’s wage increases, the American people would have gotten more bang for their tax cut bucks. Additionally, this would have created a real incentive for companies to raise wages: Increase wages, get a tax cut; don’t and you won’t.

If the justification for saddling the American people with at least $1 trillion in additional debt was greater wage growth, tax cuts should have been tied to each company’s wage growth; that’s just logical. That’s getting a better deal for the American people, and that’s getting a better return on investment.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he's a contributor to the Fed Beige Book. Find him on Twitter: @solutionomics.

Tidak ada komentar:

Posting Komentar