"akhirnya semua melihat dan medengar sekaligus juga ikut memikirkan,apa yang sedang terjadi didalam Negara Indonesia,ada apa dan mengapa musti terjadi seperti adanya hukuman mati yang sedang berlaku bagi mereka yang dianggap sebagai bandar narkoba?". Tidak hanya itu Indonesia terdengar didlam negaranya sedang berjalan dikalangan para pejabatnya terkena demam korupsi, juga bagi mereka pernah melakukan korupsi lagi sibuk-sibuknya mengadakan perlawan, dengan cara mencoba melemahkan para penegag hukum didalam negara itu, ambil perunpamaan yang sedang terjadi saat ini kedua lembaga hukum nampak jelas sedang saling melempar isu dan sampai juga persoalan di tampilkan di muka persidangan MA. antara Lembaga besar Polri sebagai pribadinya Budi Gunawan, melawan para ketua KPK, dan berakhir pada kedua belah pihak harus mendapat surat diberhentikan sementara dari pihak KPK Dua orang Bambang W, Dn Abraham S. dengan suarat yang diturunkan dari Presiden Joko W., sementara bagi saudara Budi gunawan akhirnya dengan tegas Presiden tidak bersidia melantik.Disamping itu juga APBN Indonesia yang katanya ditahun 2015 katanya akan diupayakan menjulang ketarget 2300 triliun akhirnya hanya mampuh mencampai 2000 triliun rupiah saja.Inilah yang terdengr oleh saya, cetus andri luntungan pengamat International saat mintai komentarnya siang tadi pada online, andri juga menambahkan, saniwara permaianan yang sedang berjalan seperti akan menengelamkan persoalan yang sangant penting, seperti masalah "akankah para koruptor yang telah ditahan nantinya segera juga dihukum mati,? dan kapan juga semua pelaku yang telah tarsangka sebagai pelaku korupsi akan ditangkap?. sejauh ini baru terdengar selentingan berita burung bahwa akan ada penanganan 360 kepala daerah yang diduga korupsi mereka akan segera ditangkap.Namun demikian berita burung itu apa bemar atau tidak saya belum bisa mengatakan disini,tetapi jika nantinya hal itu benar-benar nantinya ada, setidaknya kedua lembaga hukum yang saat ini seperti lagi sedang bertengkar alangkah lebih baik darisekarang mereka segera berdamai dan segera mengejar para korupsi yang telah terdaftar didalam agenda untuk segera diporses.Cetusnya."Pengamatan saya hampir delapan puluh persen para pejabat di Indonesia jika hidup hanya dari mengandalkan gajih hampir sulit kehidupan bisa dianggap mampuh, seperti buat membayar cicilan rumah, cicilan mobil,bayar uang kuliah, membayar pembantu,uang buat pelesiran, dan ditambah kehidupan sehari buat mereka makan dan sandang.Oleh sebab ketidak serba cukup mungkin disana akhirnya tidak sedikit para pejabat di Indonesia akhirnya melacurkan jabatannya , ada menjadi calo proyek, ada juga yang menjadi calo jabatan, dan juga ada pulah yang terang-terangan meminta kompensasi pada rekanan pmborong,artinya mereka minta pada pemborong 10% pada setiap pemborong yang mendapatkan kegiatan proyek diluar PPN PPH. apa dia seorang kepala dinas, kasi, sampai juga kepada kepala daerah."Inilah yang ter -isu dikalangan rekanan pemborong diseluruh Indonesia,?". Tidak hanya itu ironisnya ada juga isu bahwa buat menjadi Kepala dinas jika tidak berani nyotor sesuai yang di-inginkan jangan harap mereka dapat mendapat jabatan,"Bayamgkan jika mau dudk disebuah jabatan dan jabatan itu harus dibayar mahal, apa mungkin dia duduk disana akan bekerja normal atau maksimal.?" Artinya contoh kecilnya seperti para anggota parleman mereka duduk disana katanya mengelurkan uang besar, dengan cara merayu para pemilih dan setelah mereka berhasil merayu dan telah menajdi pendukung bisanya dibayar dan kalau duduk pasti dia akan mencari uang buat mengembalikan uangnya, artinya buat memikirkan akan membela sangant minim pada pendukungnya justru yang sering terjadi mereka meninggalkannya. Maaf mungkin jika saya nerkata seperti ini ada yang marah namun demikian semua telah terjadi dan tinggal merunungkan dengan dalam layakah hidup seperti itu bisa dibilang pengabdi negara, atau layakah perbuatan seperti itu bia dibilang manusia patriot negara,? jawabnya tidak. Jika itu jawabnya saya setuju sekarang tinggal segala pejabat yang saat ini lagi dudk dan para anggota parleman belajar hidup disiplin dan memiliki jiwa pengabdian apa pada negara dan bangsa, itu dudlu yang perlu dimiliki selama hal itu tidak pernah melekat pada diri pejabat dan parleman jangan harap korupsi akan hilang dari belantara Indonesia.Katanya.

"akhirnya semua melihat dan medengar sekaligus juga ikut memikirkan,apa yang sedang terjadi didalam Negara Indonesia,ada apa dan mengapa musti terjadi seperti adanya hukuman mati yang sedang berlaku bagi mereka yang dianggap sebagai bandar narkoba?". Tidak hanya itu Indonesia terdengar didlam negaranya sedang berjalan dikalangan para pejabatnya terkena demam korupsi, juga bagi mereka pernah melakukan korupsi lagi sibuk-sibuknya mengadakan perlawan, dengan cara mencoba melemahkan para penegag hukum didalam negara itu, ambil perunpamaan yang sedang terjadi saat ini kedua lembaga hukum nampak jelas sedang saling melempar isu dan sampai juga persoalan di tampilkan di muka persidangan MA. antara Lembaga besar Polri sebagai pribadinya Budi Gunawan, melawan para ketua KPK, dan berakhir pada kedua belah pihak harus mendapat surat diberhentikan sementara dari pihak KPK Dua orang Bambang W, Dn Abraham S. dengan suarat yang diturunkan dari Presiden Joko W., sementara bagi saudara Budi gunawan akhirnya dengan tegas Presiden tidak bersidia melantik.Disamping itu juga APBN Indonesia yang katanya ditahun 2015 katanya akan diupayakan menjulang ketarget 2300 triliun akhirnya hanya mampuh mencampai 2000 triliun rupiah saja.Inilah yang terdengr oleh saya, cetus andri luntungan pengamat International saat mintai komentarnya siang tadi pada online, andri juga menambahkan, saniwara permaianan yang sedang berjalan seperti akan menengelamkan persoalan yang sangant penting, seperti masalah "akankah para koruptor yang telah ditahan nantinya segera juga dihukum mati,? dan kapan juga semua pelaku yang telah tarsangka sebagai pelaku korupsi akan ditangkap?. sejauh ini baru terdengar selentingan berita burung bahwa akan ada penanganan 360 kepala daerah yang diduga korupsi mereka akan segera ditangkap.Namun demikian berita burung itu apa bemar atau tidak saya belum bisa mengatakan disini,tetapi jika nantinya hal itu benar-benar nantinya ada, setidaknya kedua lembaga hukum yang saat ini seperti lagi sedang bertengkar alangkah lebih baik darisekarang mereka segera berdamai dan segera mengejar para korupsi yang telah terdaftar didalam agenda untuk segera diporses.Cetusnya."Pengamatan saya hampir delapan puluh persen para pejabat di Indonesia jika hidup hanya dari mengandalkan gajih hampir sulit kehidupan bisa dianggap mampuh, seperti buat membayar cicilan rumah, cicilan mobil,bayar uang kuliah, membayar pembantu,uang buat pelesiran, dan ditambah kehidupan sehari buat mereka makan dan sandang.Oleh sebab ketidak serba cukup mungkin disana akhirnya tidak sedikit para pejabat di Indonesia akhirnya melacurkan jabatannya , ada menjadi calo proyek, ada juga yang menjadi calo jabatan, dan juga ada pulah yang terang-terangan meminta kompensasi pada rekanan pmborong,artinya mereka minta pada pemborong 10% pada setiap pemborong yang mendapatkan kegiatan proyek diluar PPN PPH. apa dia seorang kepala dinas, kasi, sampai juga kepada kepala daerah."Inilah yang ter -isu dikalangan rekanan pemborong diseluruh Indonesia,?". Tidak hanya itu ironisnya ada juga isu bahwa buat menjadi Kepala dinas jika tidak berani nyotor sesuai yang di-inginkan jangan harap mereka dapat mendapat jabatan,"Bayamgkan jika mau dudk disebuah jabatan dan jabatan itu harus dibayar mahal, apa mungkin dia duduk disana akan bekerja normal atau maksimal.?" Artinya contoh kecilnya seperti para anggota parleman mereka duduk disana katanya mengelurkan uang besar, dengan cara merayu para pemilih dan setelah mereka berhasil merayu dan telah menajdi pendukung bisanya dibayar dan kalau duduk pasti dia akan mencari uang buat mengembalikan uangnya, artinya buat memikirkan akan membela sangant minim pada pendukungnya justru yang sering terjadi mereka meninggalkannya. Maaf mungkin jika saya nerkata seperti ini ada yang marah namun demikian semua telah terjadi dan tinggal merunungkan dengan dalam layakah hidup seperti itu bisa dibilang pengabdi negara, atau layakah perbuatan seperti itu bia dibilang manusia patriot negara,? jawabnya tidak. Jika itu jawabnya saya setuju sekarang tinggal segala pejabat yang saat ini lagi dudk dan para anggota parleman belajar hidup disiplin dan memiliki jiwa pengabdian apa pada negara dan bangsa, itu dudlu yang perlu dimiliki selama hal itu tidak pernah melekat pada diri pejabat dan parleman jangan harap korupsi akan hilang dari belantara Indonesia.Katanya.

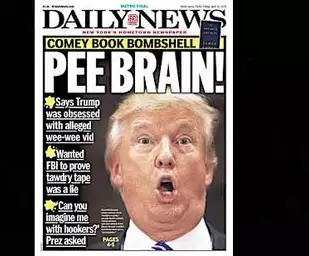

The latest Employment Situation report from the Bureau of Labor Statistics shows weekly employee earnings have grown $75 since tax reform passed, well short of the $4,000 to $9,000 annual increases projected by President Trump Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan

Donald John TrumpRobert De Niro, Ben Stiller play Mueller and Cohen in 'SNL' parody of 'Meet the Parents' Trump order targets wide swath of public assistance programs Comey says Trump reacted to news of Russian meddling by asking if it changed election results MORE and House Speaker Paul Ryan Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

Paul Davis RyanTrump order targets wide swath of public assistance programs Sunday shows preview: White House officials talk Syria strike Wage growth well short of what was promised from tax reform MORE (R-Wis.).

During the three months following passage of the tax bill, the average American saw a $6.21 increase in average weekly earnings. Assuming 12 weeks of work during the three months following passage of the corporate tax cuts, this equates to a $75 increase.

Assuming a full 52 weeks of work, the $6.21 increase in weekly earnings would result in a $323 annual increase, nowhere near the minimum $4,000 promised and $9,000 potential annual increases projected by President Trump and Speaker Ryan if significant cuts were made to corporate tax rates.

Unless something drastically changes, it seems that Americans are going to have to settle for much less than the $4,000 to $9,000 projected wage increases. An extra $322 a year isn’t going to do much to pay down the $1 trillion in additional debt they are projected to take on as a result of the tax cuts.

Yet, a key part of the argument for the recently passed corporate tax cuts and more than a trillion dollars in debt was the substantial wage hike promised by the president’s Council of Economic Advisers (CEA).

From a document titled, “Corporate Tax Reform and Wages: Theory and Evidence,” on the White House’s website:

“Reducing the statutory federal corporate tax rate from 35 to 20 percent would, the analysis below suggests, increase average household income in the United States by, very conservatively, $4,000 annually.”

The document goes on to say:

“When we use the more optimistic estimates from the literature, wage boosts are over $9,000 for the average U.S. household.”

No less than Speaker Ryan’s website trumpeted the Council of Economic Advisers report claiming that on average, the proposed corporate tax cuts would result in at least a $4,000 annual increase in wages.

Now, some supporters of the tax bill may say this analysis is unfair because it is too early for the effects of the tax bill to show up in wages. By that logic, they also shouldn’t take credit for reported employment growth increases.

Still others may point to the $1,000 bonuses announced by some companies shortly after passage of the tax bill. First, that is significantly less than the promised $4,000 to $9,000. Second, these are not wage increases; these are one-time bonuses.

Will companies pay them again, and if so when? Third, the $1,000 represents a fraction of the estimated potential company tax savings.

Using 2016 net income, 2016 effective tax rates, the new 21-percent corporate tax rate and company bonuses, we estimated company bonuses as a percentage of a number of company’s potential tax savings. The results: In many cases, the bonuses represent a mere pittance of the possible tax savings.

Navient announced that it would be giving $1,000 bonuses to 98 percent of its 6,7000 employees, paying out nearly $7 million in bonuses. While that may seem generous, it pales in comparison to Navient’s potential tax savings.

Using Navient’s 2016 net income, its 2016 effective tax rate, estimated annual tax savings of nearly $200 million and its announced bonuses, we calculated that the announced bonuses represent less than 4 percent of Navient’s potential tax savings.

Turning to the airline industry, JetBlue’s employees might be feeling blue if they realized that their $1,000 bonuses are estimated to be less than 10 percent of JetBlue’s potential tax savings, while American Airlines’ bonuses are estimated to represent less than 15 percent of its estimated potential annual tax savings

Not to be outdone, Comcast’s bonuses represent less than 8 percent of its estimated potential annual tax savings, while Walmart appears downright generous, giving an estimated $0.16 of every dollar of its estimated potential annual tax savings to employees in the form of bonuses.

Source: Solutionomics

What happened to the minimum $4,000 promised? I guess like many promises by politicians, they were empty. Instead, they seem to have gone to share buybacks. For the period December 2017 through February 2018, share buybacks more than doubled to $200 million.

Is a $323 wage increase and a one-time bonus of $1,000 that represents a fraction of estimated potential company tax savings worth the more than $1 trillion in additional debt placed on Americans? Is this the best Congress could do? No.

Instead, Congress could have simply made each company’s tax cut contingent on each company increasing wages. The problem is that some companies receiving tax cuts didn’t raise wages.

If Congress had made each company’s tax cut contingent on each company’s wage increases, the American people would have gotten more bang for their tax cut bucks. Additionally, this would have created a real incentive for companies to raise wages: Increase wages, get a tax cut; don’t and you won’t.

If the justification for saddling the American people with at least $1 trillion in additional debt was greater wage growth, tax cuts should have been tied to each company’s wage growth; that’s just logical. That’s getting a better deal for the American people, and that’s getting a better return on investment.

Chris Macke is the founder of Solutionomics, a think tank focused on developing solutions for a more efficient, merit-based corporate tax code. He has advised the U.S. Federal Reserve by providing market updates and implications of monetary policy changes on asset valuations and market distortions, and he's a contributor to the Fed Beige Book. Find him on Twitter: @solutionomics.

Tidak ada komentar:

Posting Komentar